|

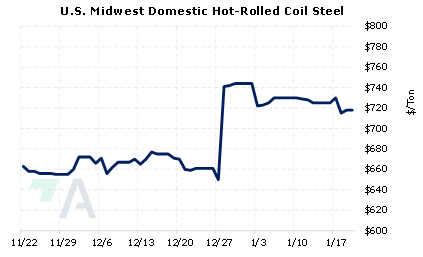

Market prices for steel show mill profitability have eroded, and forward prices don’t look much better. The HRC to busheling scrap spread was last $377/st, based on Argus’s most recent HRC and #1 busheling ferrous scrap price assessments from earlier this week. The price spread between HRC steel and busheling ferrous scrap is often used as a gauge for steel mill profitability. AEGIS notes this spread continues to drop even after the usual seasonal slowdown in November and December, as the spread sat near $424/st in mid-October. We also note that this drop in steel mill profitability comes as some large producers such as Cleveland Cliffs and Nucor are hiking prices on certain products and implementing minimum spot prices for HRC. After reaching a record $1,441/st in September 2021, this spread has steadily dropped throughout 2022 and early 2023. Based on today’s forward curves, this spread averages about $398/st throughout 2023, up slightly from the $390/st average in mid-October. (Source: Argus) |

|

|

|

Do you need to hedge this spread? Based on today’s forward curves, this spread averages about $398/st throughout 2023. Both sides of this spread can be hedged via CME HRC Steel and Busheling Scrap swaps. Since both HRC steel and Busheling scrap swaps are thinly traded, we suggest using limit orders to establish a specific price. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if HRC prices increase or busheling scrap prices decrease. Please note there is no options market for CME MW Busheling Fe Scrap. Please contact AEGIS for specific strategies that fit your operations. (1/20/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/18/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? |

||

|

|

||

| Important Headlines | ||

|

1/19/2023: Column: Exchanges diversify as base metals trade shrinks in 2022: Andy Home 1/19/2023: Viewpoint: India's domestic steel demand set to rebound 1/19/2023: Davos 2023: LME CEO says nickel reforms to be implemented 'relatively quickly' 1/17/2023: US HRC: Prices rise with higher offer levels 1/17/2023: EU, US resume talks on Al, steel decarb deal 1/16/2023: China's 2022 aluminium output hits record high of 40.21 mln tonnes 1/16/2023: Indonesia deploys security forces after nickel smelter protest turns deadly 1/15/2023: Column: Base metals start the new year with depleted inventory 1/13/2023: Thousands march in Peru capital demanding president step down |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||