|

Tin is the best-performing LME metal in 2023, soaring over 22% so far this year. AEGIS believes the recent price action could be due to Chinese buying as their economy reopens or speculation that Chinese restocking will continue its brisk pace in 2023. China imported 31,115 mt of refined tin last year, up nearly 535% from the 4,900 mt imported in 2021. Last year’s import volumes were also the highest since 2012. According to Reuters, Chinese tin demand was down last year due to the pandemic, thus, the recent significant jump in imports “suggests a major restocking exercise.” |

|

|

|

We also note that the recent jump in tin prices could also be due to Minsur’s tin mine closure in Southern Peru. Since early December, Southern Peru has been rocked by violent political protests, forcing Minsur to cease operations at its San Rafael tin mine earlier this month. According to Minsur’s website, the San Rafael operation is the leading Tin producing mine in South America and the third largest in the world. (Sources: Reuters, International Tin Association, Minsur) Tin is most often used in alloys, for example, solder or bronze. Despite the everyday usefulness of tin, it is one of the most thinly traded LME metals. Thus, we suggest alloy producers use swaps to hedge future physical purchases. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/25/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

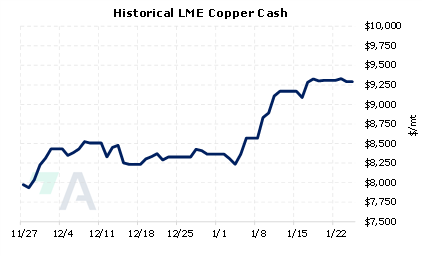

01/24/2023: Peruvian Protests Could Support Copper Prices 01/18/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? |

||

|

|

||

| Important Headlines | ||

|

1/24/2023: Column: Tin on the rebound as China scoops up surplus metal 1/23/2023: Column: Power problems rein in global aluminium output growth 1/23/2023: Ford to cut up to 3,200 European jobs, union says, vowing to fight 1/23/2023: Potanin says sanctions constrain Nornickel, force it to adjust strategy 1/21/2023: Glencore halts operations in Peru due to violent protests 1/21/2023: Over 50 injured in Peru as protests cause 'nationwide chaos' |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||