|

Due to project delays, increasing taxes, and higher development costs, Chile’s copper production will peak at 7.14 million mt in 2030, according to the Chilean Copper Commission (Cochilco). This updated forecast of peak production is both later and lower than their prior projection of 7.62 million mt in 2028. AEGIS notes that several large miners, including BHP, Freeport-McMoRan, and Antofagasta have already stated that they are holding off on new projects while Chile’s political environment remains unclear. The Chilean congress is currently rewriting the country’s constitution, and there are worries that some new regulations could be prohibitive to copper production. According to Cochilco, Chile produced an estimated 5.345 million mt last year. Chile is the world’s largest copper producer, based on USGS data. (Sources: Reuters, Bloomberg, USGS) |

|

|

|

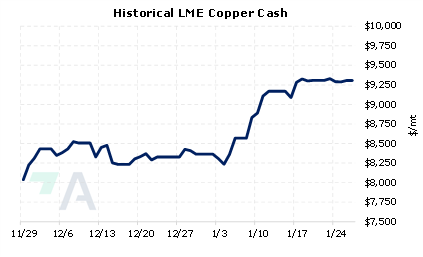

AEGIS notes that these issues in Chile could remain supportive of copper prices in 2023 and beyond. LME Copper is up nearly 11% already this year, due in part to political protests and subsequent road blockades in neighboring Peru. Even with the recent rally, this still could be a good opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/27/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

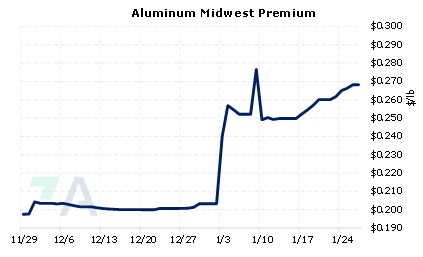

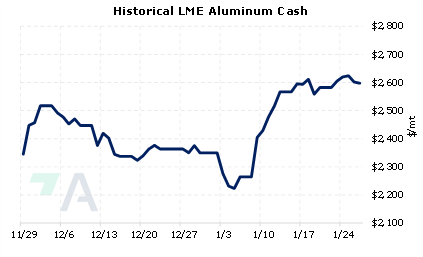

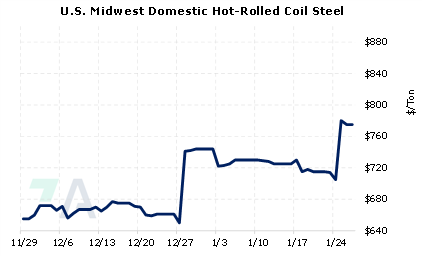

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/25/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? |

||

|

|

||

| Important Headlines | ||

|

1/26/2023: LME expands nickel committee to help improve contract, dwindling volumes 1/25/2023: Exclusive: Chile mine delays to slow copper growth; peak seen lower, later -regulator 1/25/2023: Freeport-McMoRan quarterly profit slumps on lower copper prices 1/24/2023: Column: Tin on the rebound as China scoops up surplus metal 1/23/2023: Column: Power problems rein in global aluminium output growth 1/23/2023: Ford to cut up to 3,200 European jobs, union says, vowing to fight 1/23/2023: Potanin says sanctions constrain Nornickel, force it to adjust strategy 1/21/2023: Glencore halts operations in Peru due to violent protests 1/21/2023: Over 50 injured in Peru as protests cause 'nationwide chaos' |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||