|

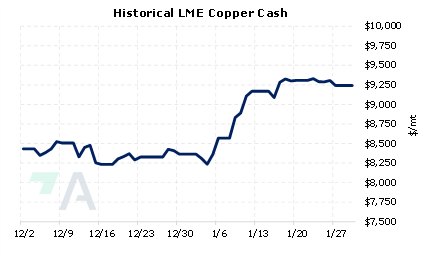

America’s reliance on foreign metals shows no sign of slowing. Last Thursday, the White House issued a 20-year moratorium on new mining in northern Minnesota. This moratorium effectively blocks Antofagasta Plc's anticipated Twin Metals copper and nickel mine project from going forward. The leases on this proposed mine have had a turbulent history. Last Wednesday, the Department of Interior pulled the leases, claiming that the Trump administration had reinstated them “in error.” The leases were initially pulled by then-President Obama in 2016; however, Trump reversed that decision. According to their website, the company projected the mine would process approximately 18,000 mt of ore per day that would have produced separate concentrates – copper, nickel/cobalt, and platinum-group metals. |

|

|

|

According to the New York Times, the US was “nearly self-sufficient” for its copper usage until the 1990s. However, because older mines have closed or become depleted, the US now relies on foreign supply for about half of its copper usage. This reliance on imports could increase to nearly two-thirds of usage by 2035, according to S&P Global. (Sources: Reuters, Bloomberg, S&P Global, New York Times, Antofagasta) Are you an end-user of either copper or nickel? AEGIS is very adept at developing strategies for both metals. For example, stainless steel producers might consider using a costless collar to hedge their nickel input costs. In this case, a “zero-cost collar” creates a maximum and minimum metals price for an end user, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging but can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/30/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/25/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? |

||

|

|

||

| Important Headlines | ||

|

1/29/2023: China's MMG flags production halt at Las Bambas in Peru due to protests 1/27/2023: Norway finds 'substantial' mineral resources on its seabed 1/27/2023: Electric vehicles throw palladium's mega-rally into reverse |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||