|

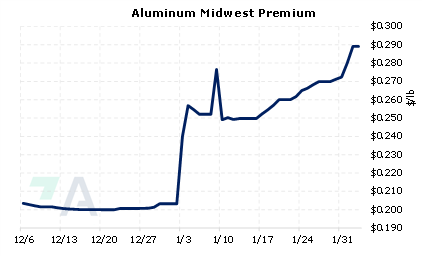

Shifting automotive production away from traditional internal combustion engines and into electric vehicles will lead to more aluminum demand, according to aluminum producer Norsk Hydro. AEGIS notes that greater aluminum demand by US automotive industry could impact aluminum Midwest Premium (MWP) prices. To help offset the weight of battery packs, many auto manufacturers will produce lighter-weight aluminum components instead of steel. These aluminum parts include not only legacy components such as crash management systems but also EV-specific battery packs. According to consultant Ducker Carlisle, last year the average vehicle produced contained 299 lbs of cast aluminum and 56 lbs of aluminum extrusions. However, due to the increasing market share by EVs, the average vehicle will contain 304 lbs of cast aluminum and 89 lbs of aluminum extrusions. Moreover, EVs will compromise 31% of the North American light vehicle market, up from 6% last year, according to Ducker Carlisle’s projections. |

|

|

|

There are three main reasons why rising EV demand could impact the MWP. First, greater demand for American aluminum products is generally bullish to prices. Secondly, domestic freight costs for moving aluminum products into the Midwest are included in the MWP, thus, greater freight demand could the MWP higher. Finally, the US imports approximately $150 billion worth of automotive parts each year, many of which are made from aluminum. As import tariffs are also included in the MWP, rising aluminum imports could also drive the MWP higher. (Source: S&P Global, Automotive Aftermarket Network) However, end-users that are exposed to the MWP can mitigate this risk via CME MWP swaps. Please note that there is no options market for the CME MWP. The CME Midwest Premium swap market is thinly traded, so hedging in that market is tricky. Thus, we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. (2/3/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/1/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear |

||

|

|

||

| Important Headlines | ||

|

2/1/2023: Column: Analysts wary of base metals after China recovery rally 1/31/2023: US HRC: Prices flat, range tightens 1/31/2023: UPDATE 1-Philippine nickel mining group rejects proposed tax on ore exports 1/31/2023: INTERVIEW: EVs present key area of growth for US aluminum extrusions: Hydro executive 1/31/2023: Explainer: Why are there protests in Peru and what comes next? 1/31/2023: Squeezed mining companies face growth dilemma 1/30/2023: Russian carmaker Avtotor launches production of Chinese Kaiyi cars 1/30/2023: Column: China hikes aluminium tariffs but export boom already over 1/29/2023: China's MMG flags production halt at Las Bambas in Peru due to protests 1/27/2023: Norway finds 'substantial' mineral resources on its seabed 1/27/2023: Electric vehicles throw palladium's mega-rally into reverse 1/27/2023: 5 things we learned at Fastmarkets’ Scrap & Steel ’23 conference |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||