|

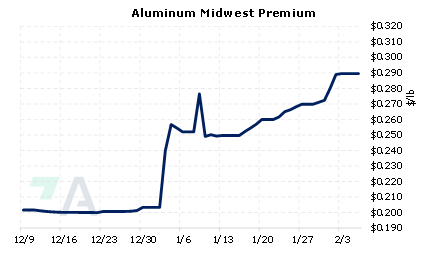

Shortages of high-purity aluminum and competition over units have led to a surge in international import premiums in early 2023. Several traders recently interviewed by Fastmarkets claim that most of Europe is in short supply of high-purity P0610 aluminum, and those that do have inventory are holding back sales in anticipation of higher prices. This shortage in Europe has led to a scramble to buy from international suppliers, thereby pushing up the spot European delivered duty-paid premium to $321/mt, up $68/mt since January 1. To compete for the cargoes that might otherwise go to Europe, American buyers have rallied the US aluminum Midwest Premium (MWP) to nearly $638/mt, up $190/mt since January 1. (Source: CME, Fastmarkets) |

|

|

|

As spot premiums have increased, CME MWP futures prices have also rallied. However, shorter-term contracts have rallied more than further down the forward curve. For example, the prompt month February 2023 contract has rallied approximately 3 cents, while the remainder of calendar year 2023 has only rallied about a penny. Please also note forward curve is now backwardated through April 2023, but then largely goes flat beyond that contract. This means that end-users can hedge future usage at a discount to spot prices. Please note that there is no options market for the CME MWP. The CME Midwest Premium swap market is thinly traded, so hedging in that market is tricky. Thus, we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. (2/6/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/1/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear |

||

|

|

||

| Important Headlines | ||

|

2/6/2023: Analysis: Dollar's gyrations raise hedging costs for U.S. companies |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||