|

After peaking at just over $40/lb. in May 2022, CME cobalt prices have tumbled by nearly 60% due to falling Chinese demand. According to Rystad Energy, cobalt demand by China’s electronics sector has fallen by 30% to 40% over the last year. AEGIS notes that cobalt prices are especially susceptible to electronics demand. This is because electronics such as laptops, cell phones, and tablets require more cobalt on a “pound-for-pound” basis relative to electric vehicles.

|

|

|

|

Continuing on EV production, the automotive sector’s cobalt demand is still rising but could wane in the future. According to Bloomberg, car manufacturers are switching to batteries that require less or no cobalt. Moreover, some analysts predict that the automotive sector’s demand for lithium will increase while cobalt usage will fall. (Source: Bloomberg) AEGIS notes that the financial market for cobalt has boomed in recent months. For example, aggregate open interest for CME cobalt futures is currently about 17,000 contracts, up from a mere 2,000 contracts in April 2022. The open interest is steady throughout the forward curve into early 2024. Currently, the June ’23 through May ’24 contracts all have an open interest of between 730 to 840 contracts. There is currently no options market for CME cobalt, but end-users such as electronics producers can hedge future needs via swaps. Using swaps can help guard against a potential increase in cobalt input costs. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (2/10/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

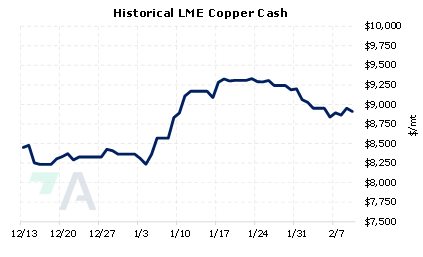

02/8/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/8/2023: Glencore deposits more Russian aluminium on LME system -sources 2/8/2023: Exclusive: Peru mines on power despite protests, though halt risk looms 2/6/2023: U.S. considering 200% tariff on Russian aluminum, official says 2/6/2023: Analysis: Dollar's gyrations raise hedging costs for U.S. companies |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||