|

An astounding 5.2 billion mt of steel, aluminum, copper, cobalt, and other metals will be required to achieve net zero global emissions by 2050, according to Bloomberg estimates. AEGIS notes that this transition could put upward pressure on most metals prices unless supply dramatically increases. We also note that multi-decade supply and demand projections are very likely to be less accurate than expected. This could lead to greater price volatility if actual supply or demand differs greatly from these initial projections. |

|

|

|

Based on Bloomberg estimates, approximately 270.5 million mt/year of steel is used for the energy transition; however, this volume will jump to almost 1.1 billion mt/year by 2050. Similarly, copper usage for the energy transition will jump nearly six-fold to 38.3 million mt/year, and aluminum demand will grow roughly five-fold to 80.3 million mt/year. (Source: Bloomberg) AEGIS believes that those directly involved or affected by this energy transition will likely require hedging strategies involving both LME and CME metals. These tactics might include simple strategies such as buying swaps or call options. Please note that some CME & LME metals have no options market (like CME cobalt), and several have options market with low liquidity (such as CME HRC steel). Please contact AEGIS for specific strategies that fit your operations. (2/13/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

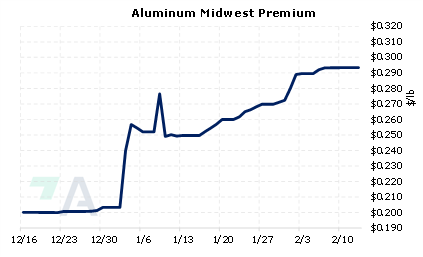

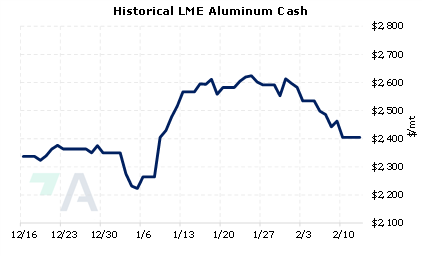

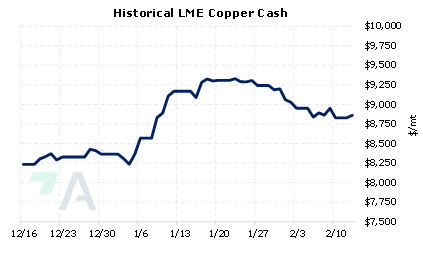

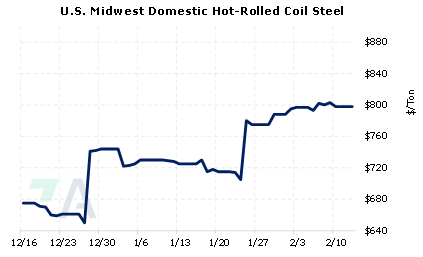

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/8/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/10/2023: Copper heads for third straight weekly loss on weak Chinese demand 2/9/2023: UPDATE 1-Russian metal makes up 42% of LME warehouses' stocks -report 2/8/2023: Glencore deposits more Russian aluminium on LME system -sources 2/8/2023: Exclusive: Peru mines on power despite protests, though halt risk looms 2/6/2023: U.S. considering 200% tariff on Russian aluminum, official says 2/6/2023: Analysis: Dollar's gyrations raise hedging costs for U.S. companies |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||