|

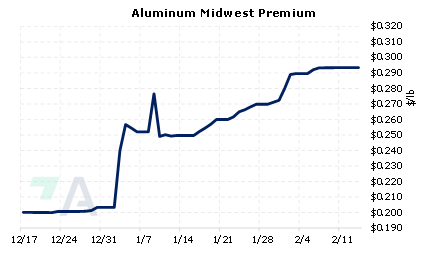

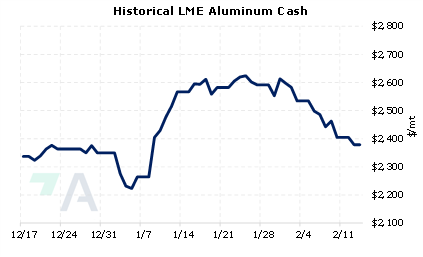

As of January 31, approximately 41% of the primary aluminum, or 93,750 mt, that is in LME warehouses is of Russian-origin, according to the newly initiated LME Country of Origin stock report from last Friday. AEGIS notes that the amount of Russian aluminum in LME warehouses has likely increased since January 31, and could be why LME prices have stalled this month. Last week, aluminum stocks in South Korea jumped by over 100,000 mt, and Reuters reports suggest that this metal was of Russian-origin. Glencore, who is the top-customer of Russian aluminum producer Rusal, was responsible for last week’s deliveries, according to the same reports. |

|

|

|

We also note that inflows of Indian-origin aluminum have likely increased in February and could have also added to the recent pressure on aluminum prices. Yesterday morning, 91,825 mt of aluminum was delivered into Malaysian LME warehouses. According to Reuters, Malaysian LME warehouses are a known delivery point for Indian-origin metals. As of January 31, approximately 53% of the primary aluminum, or 122,850 mt, that is in LME warehouses is of Indian origin, according to the LME Country of Origin stock report. (Source: Reuters, LME) Many traders have feared that allowing large amounts of metal onto the exchange could distort global prices. The reasons behind this are two-fold. First, to deliver to the exchange, a trader such as Glencore needs to open a (likely large) short position. Opening a large short position could put downward pressure on prices. Also, delivering to the exchange likely occurs when a trader cannot find a physical buyer or end-user for the metal. This signals that market demand is falling. Are you concerned that more deliveries onto the LME could occur? More importantly, are you concerned more deliveries could lead to lower prices? Those carrying inventory and concerned about decreasing prices might consider hedges that provide downside protection, such as selling swaps or buying put options. Such positions are standard; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (2/14/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

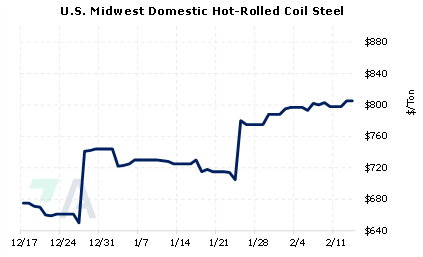

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

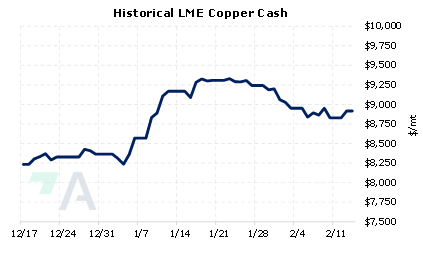

02/8/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/10/2023: Copper heads for third straight weekly loss on weak Chinese demand 2/9/2023: UPDATE 1-Russian metal makes up 42% of LME warehouses' stocks -report 2/8/2023: Glencore deposits more Russian aluminium on LME system -sources 2/8/2023: Exclusive: Peru mines on power despite protests, though halt risk looms 2/6/2023: U.S. considering 200% tariff on Russian aluminum, official says 2/6/2023: Analysis: Dollar's gyrations raise hedging costs for U.S. companies |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||