|

Norwegian aluminum producer Norsk Hydro thinks that aluminum demand will increase due to improving macroeconomic conditions. As for supply, they believe that recently shuttered aluminum smelters will remain closed despite increasing aluminum prices and falling energy costs. AEGIS notes that both factors could remain supportive of prices, especially if demand increases more than expected, or supply continues to fall. Norsk Hydro essentially said as much, stating that another 600,000 tons of production capacity could be curtailed if European energy prices rise again. In a recent interview on Bloomberg TV, Norsk Hydro’s CFO proclaimed “smelters in Europe that don’t have long-term power contracts, the situation still looks challenging… We haven’t seen a lot of restarts apart from the state-subsidized ones.” |

|

|

|

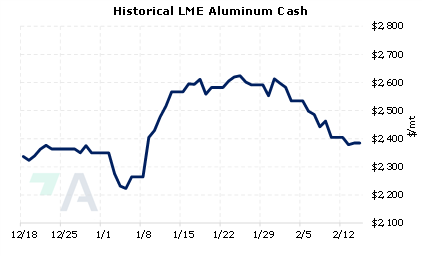

Extrapolating on Norsk Hydro’s comments regarding production, AEGIS notes that only one European aluminum smelter, Aluminum Dunkerque, has announced a ramp up in production after a previous curtailment. Echoing Norsk Hydro’s comments on subsidies, we note that Aluminum Dunkerque buys most of its power through a French nuclear-power program known as ARENH, with the remainder of its power needs is purchased at market prices. Moreover, approximately 1.16 million mt/yr, or 26% of Europe’s annual smelter capacity, remains offline due to poor demand or high electricity prices, based on AEGIS estimates. LME aluminum prices fell throughout most of 2022 as falling global demand outweighed supply concerns. However, prices have rallied so far in 2023, mainly because many market participants believe Chinese demand will increase this year. As both AEGIS and Norsk Hydro suggest, prices could rally further, especially if other regions see an uptick in aluminum demand. Aluminum end-users that are bullish on price can hedge this price risk via swaps or call options. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (2/15/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

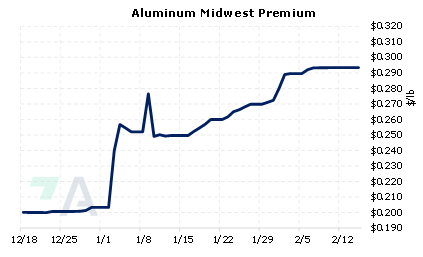

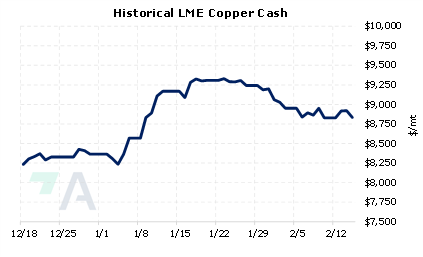

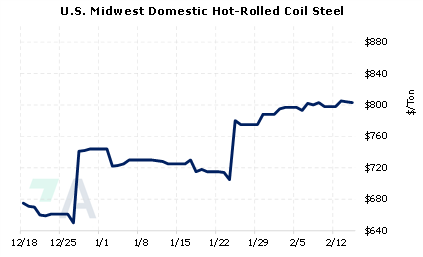

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/8/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/10/2023: Copper heads for third straight weekly loss on weak Chinese demand 2/9/2023: UPDATE 1-Russian metal makes up 42% of LME warehouses' stocks -report 2/8/2023: Glencore deposits more Russian aluminium on LME system -sources 2/8/2023: Exclusive: Peru mines on power despite protests, though halt risk looms 2/6/2023: U.S. considering 200% tariff on Russian aluminum, official says 2/6/2023: Analysis: Dollar's gyrations raise hedging costs for U.S. companies |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||