|

Supply gluts for EV metals such as nickel, lithium, and cobalt will pressure prices this year, according to the China Nonferrous Metals Industry Association. AEGIS believes end-users of these metals can use short-term price and demand drawdowns to hedge for the long-term. Specifically for nickel, the Chinese association believes that prices will fall in 2H2023. These comments reiterate Goldman Sachs’s bearish outlook on EV metals due to “surging production.” Similarly, Rystad Energy recently stated that EV demand in China has slowed, leading to “thin” spot demand for nickel, lithium, and cobalt. Therefore, Rystad believes EV metals prices will remain subdued through 1Q2023. |

|

|

|

For all our clients, AEGIS suggests knowing, in advance, the commodity price that would satisfy your procurement budget. If that price is above current market prices, then perhaps you have the ability to wait for a potential dip in prices, then you hedge forward more aggressively. However, we must point out that these markets have sufficient liquidity to create a level of "efficiency," where known supply, demand, regulatory, etc. issues are well understood and discussed. This usually results in forward prices that already reflect market conditions. Therefore, if you are waiting to hedge on a potential decrease in prices, we prefer another tactic: hedge a "foundation" level of metal right now, if the price agrees with your budget. Use remaining volumes to average-down your cost if the market gives you such an opportunity. The financial markets for EV metals such as cobalt and lithium have seen greater investor interest over the past 12 months. Therefore, car manufacturers can use those markets to hedge longer-term price risk and possibly diminish spot market price exposure. Such end-users might consider using multiple strategies, such as buying swaps or call options. Please note that some metals such as CME Cobalt and CME Lithium do not have options markets. Please contact AEGIS for specific strategies that fit your operations. (2/16/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

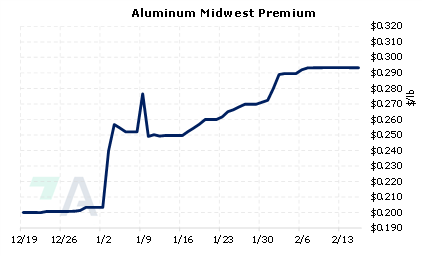

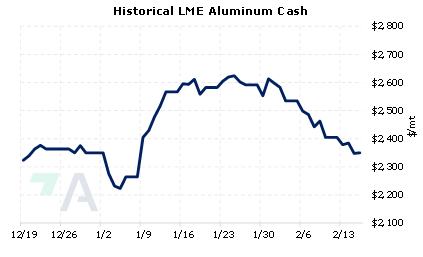

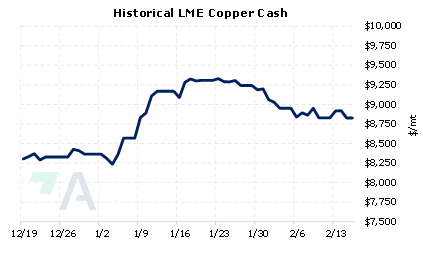

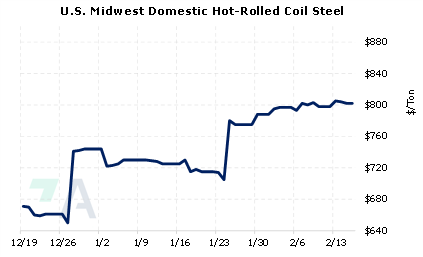

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/15/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/14/2023: EU lawmakers approve effective 2035 ban on new fossil fuel cars 2/10/2023: Copper heads for third straight weekly loss on weak Chinese demand 2/9/2023: UPDATE 1-Russian metal makes up 42% of LME warehouses' stocks -report 2/8/2023: Glencore deposits more Russian aluminium on LME system -sources |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||