|

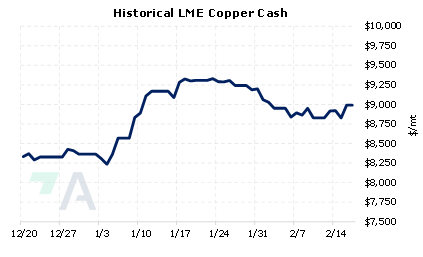

LME copper prices have trended sideways in 2023; however, AEGIS believes the prices could start to move higher on improving Chinese demand prospects and supply concerns in Indonesia and Panama. Specifically on China, the country’s real-estate sector has recently experienced falling home prices and poor sales, both of which have weighed on copper demand. However, government stimulus efforts to prop the real-estate sector could be working, as Chinese home prices rose in January, halting 16 straight months of price declines. Although this is welcome news, analysts recently told Reuters that more stimulus measures are needed to spark demand and create long-term recovery for the housing sector. |

|

|

|

As for supply, mine closures in both Indonesia and Panama could be further supportive to copper prices. Earlier this week, Freeport-McMoRan stated it is suspending operations at its Grasberg copper mine in Indonesia due to mudslides. The Grasberg mine is one the largest in the world and is responsible for about 3% of global copper production. As for Panamanian production, operations continue at the Cobre Panama; however, an ongoing tax and royalty dispute could lead to a closure, according to its parent company, First Quantum Minerals. Based on USGS figures and company data, the Cobre Panama is responsible for approximately 1.5% of global production. (Sources: China National Bureau of Statistics, Bloomberg, Reuters, USGS) AEGIS notes that the recent stall in copper prices could provide a good opportunity for end-users to implement a long-term hedging program. We cite long-term price risk as key reason to execute such a hedging program, especially since several analysts and producers recently interviewed by Bloomberg believe the “energy transition” will be long-term bullish for copper demand and prices. Thus, end-users might consider hedging future needs into 2023 and beyond by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. *Please note that our offices will be closed on Monday, February 20 due to the President’s Day holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * (2/17/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/15/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/16/2023: Peru protests jolt mine activity with Las Bambas, Antapaccay hit hardest 2/14/2023: EU lawmakers approve effective 2035 ban on new fossil fuel cars 2/10/2023: Copper heads for third straight weekly loss on weak Chinese demand 2/9/2023: UPDATE 1-Russian metal makes up 42% of LME warehouses' stocks -report 2/8/2023: Glencore deposits more Russian aluminium on LME system -sources |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||