|

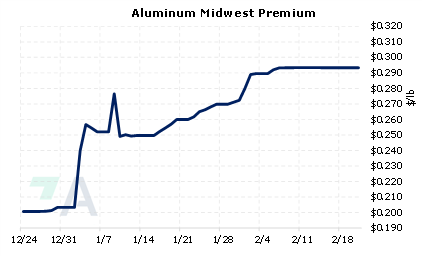

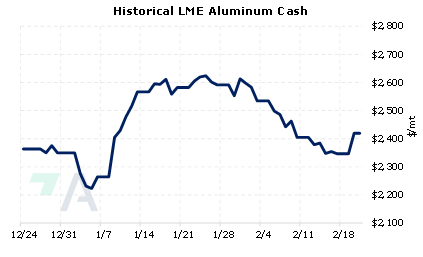

Aluminum prices could rally this year if Chinese supply dwindles even further, thereby forcing Chinese buyers to further tap into global supplies. Yunnan province, which is one of China’s main aluminum production regions, has ordered its aluminum smelters to curtail 415,000 mt of annual capacity due to low hydropower generation, according to Bloomberg. Jack Shang from Citigroup believes this curtailment could last through 1H2023, as the region remains plagued with production and electricity supply issues. This latest round of production cuts adds to the nearly one million mt of cuts last fall, thereby bringing total curtailments to approximately 1.4 million mt of annual capacity. At 5.3 million mt, Yunnan Province is responsible for about 12% China’s aluminum production. |

|

|

|

According to Bloomberg, both steady demand and unreliable power issues in key production areas such as Yunnan province have led to increasing Chinese aluminum imports during the pandemic era. AEGIS notes that Chinese aluminum imports have risen alongside global prices. Relative to history, this is quite unusual, as normally their imports rise when global prices are low. Furthermore, Chinese aluminum end-users could be forced to continue importing, if more domestic supply goes offline. We also note that LME aluminum prices are relatively flat this year, as hopes that Chinese aluminum demand will increase have largely subsided. However, as we suggest above, prices could rise if China continues importing at a rapid pace. Aluminum end-users that are concerned about rising prices can hedge this price risk via swaps or call options. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (2/21/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/15/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

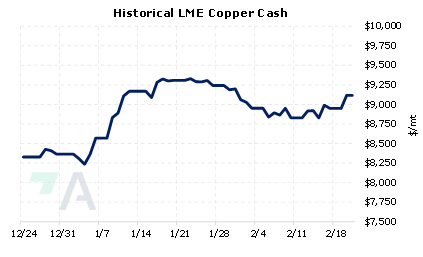

2/17/2023: First Quantum sets Feb. 23 as date to halt Panama operations amid dispute 2/17/2023: Russians switch to used cars as sanctions pummel auto sector 2/16/2023: Exclusive: First Quantum warns employees that Panama mine may close if dispute is not settled 2/16/2023: Steep levies on Russian aluminium could threaten U.S. nickel supply 2/16/2023: Peru protests jolt mine activity with Las Bambas, Antapaccay hit hardest |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||