|

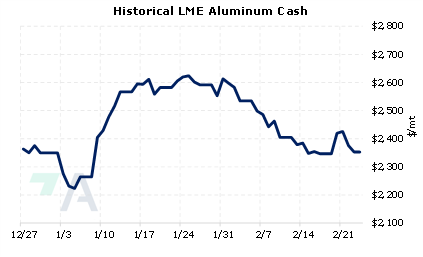

Early this morning, the White House announced they will increase tariffs on nearly 100 Russian metals, minerals, and chemical products, including aluminum products. However, they did not detail how much the tariffs will increase, nor when they will come into effect. Specifically for aluminum, the White House stated that these measures will “significantly increase costs for aluminum that was smelted or cast in Russia to enter the US market.” Previous reports from Bloomberg and other new agencies suggested the White House was considering a 200% tariff on imports of Russian aluminum. The current tariff is 35%. This announcement comes on the one-year anniversary of the start of the Russia-Ukraine conflict. (Sources: Bloomberg, White House) |

|

|

|

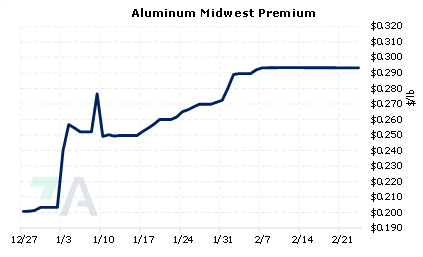

AEGIS believes that another tariff could effectively shut off our imports of Russian aluminum. As for the potential impact on US importers, this tariff is likely to be bullish for the aluminum Midwest Premium (MWP). Only about 3% of our aluminum imports currently come from Russia; however, those that buy Russian aluminum would need to fill the void by buying from other global suppliers. As our buyers compete for the same cargoes as other major importers, the MWP would likely need to rise to entice cargoes that would otherwise go to Europe or elsewhere. Please contact us for further thoughts on the Russian tariff/sanction situation and implications for the MWP. As we suggested above, the MWP could rally if Russian supplies into the US fall to zero. However, American aluminum end-users can mitigate this price risk by hedging with CME MWP swaps. The forward curve is now backwardated through May 2023, but then largely goes flat beyond that contract. This means that end-users can hedge future usage at a discount to spot prices. Please note that there is no options market for the CME MWP. The CME Midwest Premium swap market is thinly traded, thus, we recommend using limit orders, as doing so would allow you to control your purchase price. For example, if you were trying to buy the MWP at 30 cents, by using a limit order, you are attempting to lock in a price of 30 cents or better. Please contact AEGIS for specific strategies that fit your operations. (2/24/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

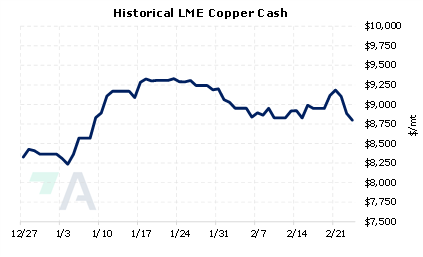

02/22/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

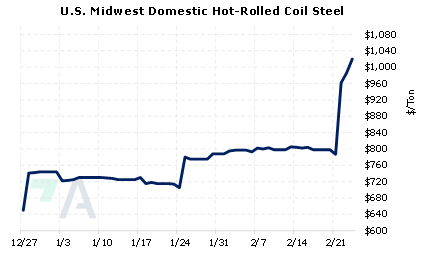

2/23/2023: First Quantum suspends ore processing at disputed Panama mine 2/22/2023: Rio Tinto slashes dividend as profit plunges on slower China demand 2/21/2023: US HRC: Prices jump as mills again hike prices 2/21/2023: BHP Group says reform to LME nickel contract 'long overdue' |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||