|

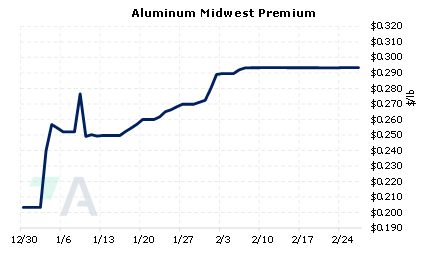

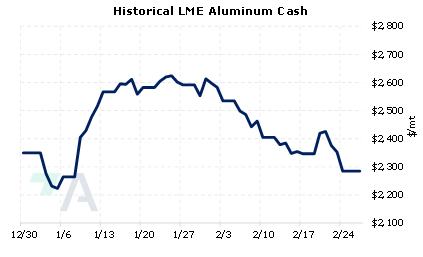

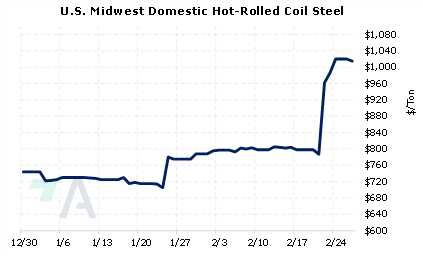

Last Friday, the White House announced it will increase tariffs on imports of Russian aluminum to 200%, up from the current level of 35%. Prior to this announcement, Reuters recently suggested that Russia might retaliate by banning sales of palladium and nickel to the US. Even though US import premiums for palladium and nickel cannot be directly hedged, AEGIS believes that most of the price risk that could come from such a ban can be hedged via palladium or nickel swaps. |

|

|

|

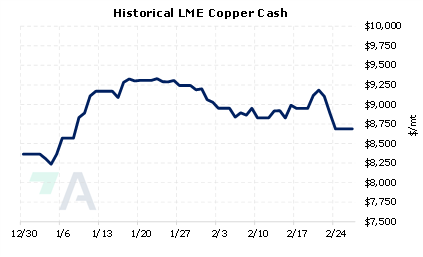

The possibility of Russian banning sales of nickel and palladium is of grave importance, as the US gets approximately 35%, or 20 mt, of its palladium imports from Russia. Similarly, 11%, or 92,000 mt, of US nickel imports come from Russia. If Russia bans exports of palladium and nickel to the US, then American buyers need to source these metals from other suppliers. Please keep in mind that if Russian metal is sold elsewhere, it suppresses that region's price via more supply, and supports the US price, via less supply. As we compete for the same cargoes as other major importers, such a ban could create havoc on US import premiums. (Sources: Bloomberg, Reuters, Trade Data Monitor) Please note that although there are assessments for nickel import premiums into the US, this premium cannot be directly hedged by a futures or swaps market. There are no known import premiums for palladium. Thus, the lack of tradable financial products further complicates the issues that American palladium and nickel buyers could face. As AEGIS suggests above, although nickel or palladium import premiums cannot be hedged, AEGIS can help develop and implement strategies that can hedge most of your price risk exposure. This might include LME nickel swaps, and likewise CME palladium swaps. Both are considered the global benchmark for their respective markets and are therefore relevant for hedging your price risk exposure. Please note that although options are available for both markets, they are quite illiquid. Please contact AEGIS for specific strategies that fit your operations. (2/27/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/22/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/24/2023: Aluminium prices shrug off 200% U.S. import tariffs for Russia 2/24/2023: A Proclamation on Adjusting Imports of Aluminum Into the United States 2/24/2023: U.S. Treasury sanctions Russian mining sector, goes after sanctions evasion 2/24/2023: U.S. targets Russia with sanctions, tariffs on war anniversary 2/23/2023: First Quantum suspends ore processing at disputed Panama mine |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||