|

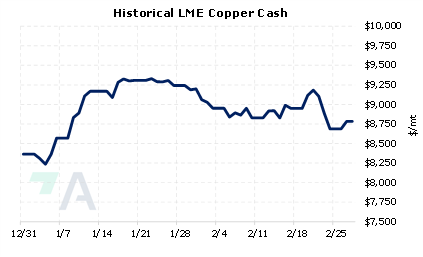

Last Thursday, First Quantum Minerals, the parent company of the huge Cobre Panama copper mine, stated that they have been forced to stop ore processing at the mine because the Panamanian government is blocking its metal from being loaded at the port. This presents a potentially bullish price risk for consumers, as blockage keeps nearly 1.5% of the global copper off the market. Even though prices have already rallied by over 6% in 2023, this could still be a good time for end-users to implement a long-term hedging program. |

|

|

|

First Quantum Minerals believes this blockage is a negotiating tactic stemming its ongoing dispute with the Panamanian government over tax and royalty payments. However, the Panamanian government claims it’s a compliance issue that is not related to the dispute. Based on USGS figures and company data, Cobre Panama produced 351,000 mt of copper in 2022, making it responsible for approximately 1.5% of global production. AEGIS notes that this export blockage adds to the woes that the Central and South American copper mining industries have faced in early 2023. Political protests and subsequent road blockages in southern Peru have forced several of the world’s copper mines to curtail production fully or partially. In neighboring Chile, water supply issues and project delays have led to lower-than-expected production volumes in 2022 and 2023. Chile and Peru are the world’s largest and second-largest copper producers, according to the USGS. (Sources: Bloomberg, Reuters, USGS) Not only are the supply issues a bullish catalyst for copper prices, but AEGIS believes the “energy transition” presents a potential, longer-term bullish stimulant for copper demand and prices. For example, according to Energy Industry Review, electric vehicles require three to four times more copper than traditional internal combustion engines. Moreover, Energy Industry Review suggests that there is not enough copper to meet the coming demand. Thus, end-users might consider hedging future needs into 2023 and beyond by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (2/28/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

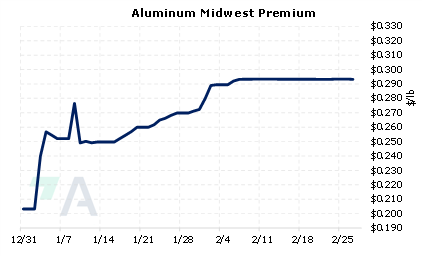

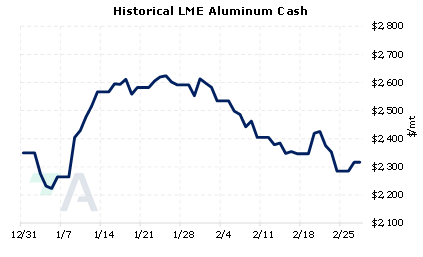

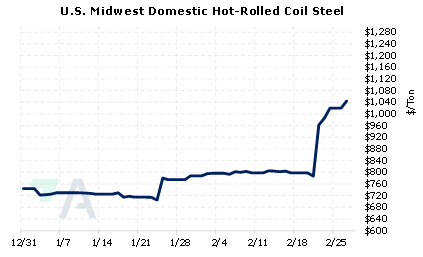

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/22/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

2/28/2023: Analysis: Lithium price slide deepens as China battery giant bets on cheaper inputs 2/24/2023: Aluminium prices shrug off 200% U.S. import tariffs for Russia 2/24/2023: A Proclamation on Adjusting Imports of Aluminum Into the United States 2/24/2023: U.S. Treasury sanctions Russian mining sector, goes after sanctions evasion 2/24/2023: U.S. targets Russia with sanctions, tariffs on war anniversary 2/23/2023: First Quantum suspends ore processing at disputed Panama mine |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||