|

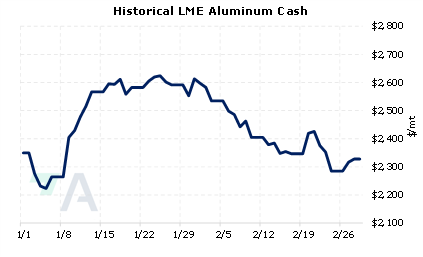

Yesterday, the LME announced that Russian metals cannot be delivered to US-based LME warehouses. This action stems from the White House’s announcement last week Friday that it will soon implement a 200% tariff on imports of Russian aluminum. AEGIS believes that the LME’s announcement will have little to no market impact on the Midwest Premium (MWP) because there is currently no Russian primary aluminum, lead, nickel, or copper in US-based LME warehouses. However, if you are concerned that this might have a bullish impact, then AEGIS believes US consumers should maintain their standard hedging policy. (Source: LME) |

|

|

|

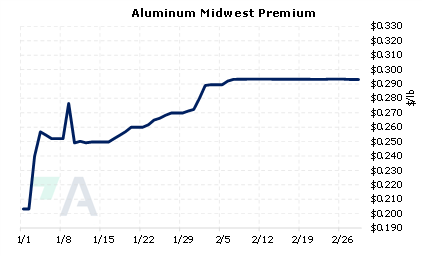

AEGIS notes that although no other major importers of aluminum have implemented a similar tariff, we ponder what the LME will do if other countries also apply a restrictive tariff similar to US’s. The White House’s tariffs would essentially block imports of Russian aluminum from the US market. If other importers follow suit, would the LME block deliveries of Russian metals into other warehouses, namely in Europe? We note that South Korean warehouses hold most of the Russian-origin primary aluminum that is in the LME system. Thus, like the US, blocking Russian metals from Euro-based warehouses would likely have a minimal market impact. However, AEGIS believes the White House’s announcement could have a wider implication for aluminum import premiums. For example, if Euro-zone countries implement a similar tariff, major buyers would be forced to seek out other suppliers. European import premiums have already rallied about 19% this year due to shortages of high-purity aluminum and could rally further if Russian supplies are blocked from the market. More importantly, as we compete for the same cargoes, this could pull the US MWP ever higher. The MWP has rallied over 44% due to the high-purity aluminum shortages in Europe and could rally further if more Russian supply is blocked from the market. However, American aluminum end-users can mitigate this price risk by hedging with CME MWP swaps. The forward curve is now backwardated through May 2023, but then largely goes flat beyond that contract. This means that end-users can hedge future usage at a discount to spot prices. Please note that there is no options market for the CME MWP. The CME Midwest Premium swap market is thinly traded, thus, we recommend using limit orders, as doing so would allow you to control your purchase price. For example, if you were trying to buy the MWP at 30 cents, by using a limit order, you are attempting to lock in a price of 30 cents or better. Please contact AEGIS for specific strategies that fit your operations. (3/1/2023 |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

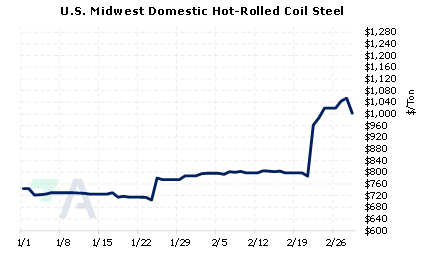

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/22/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

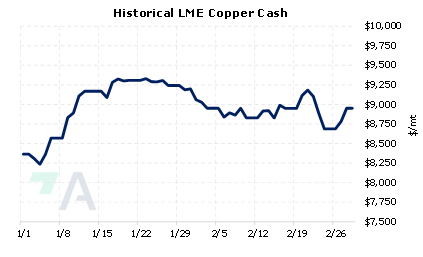

2/28/2023: LME halts flow of Russian metals into its U.S. warehouses 2/28/2023: Column-United States targets Russian aluminium and other metals: Andy Home 2/27/2023: Stellantis invests $155 mln in Argentine copper mine 2/28/2023: Analysis: Lithium price slide deepens as China battery giant bets on cheaper inputs 2/27/2023: A $1.5 billion hoard of copper and cobalt is piling up in Congo |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||