|

HRC Steel Most American steel producers have raised their base price for physical sales to $1,100/st or higher, up from $460-510/st in late November, according to Argus. These price hikes in the physical market have also caused prompt month CME HRC futures (March) to rally nearly $300/st since mid-January. AEGIS notes that most of this rally has occurred towards the front end of the futures curve, leading to a severely backwardated market. Despite this significant rally, a backwardated market favors the consumer who needs to do long-term hedging, as futures prices are lower than the prompt month.

|

Steel buyers have had to accept these ever-increasing prices, largely because end-user demand has increased, causing service center inventories to dwindle. Steelmakers have been disciplined about production in recent months, with capacity utilization levels at 75% since October. These factors have helped push up both spot and futures since last fall.

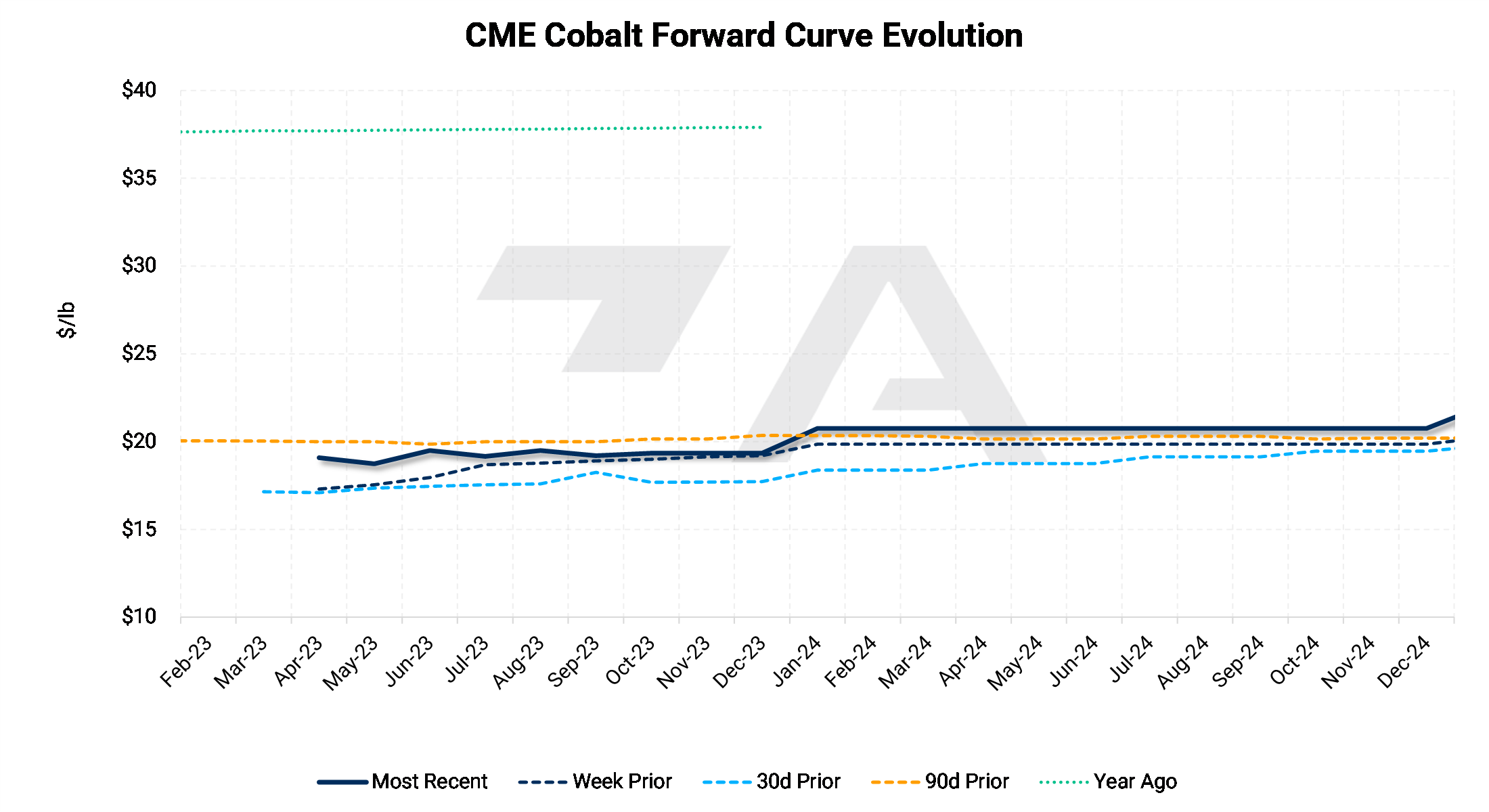

Cobalt

Due to an expected cobalt market surplus of 5,570 mt, Liberum Capital predicts that cobalt prices will average $24.90/lb. in 2023, and $22.90/lb. in 2024. AEGIS is intrigued by these forecasts, as both are higher than the current 2023 average CME Cobalt futures price of $18.25/lb., and the $19.72/lb. approximate average for 2024 CME Cobalt futures. We also note that spot cobalt prices have already dropped 60% from the highs of mid-2022, likely due to this expected supply surplus.

AEGIS feels that battery producers should hedge future usage while the market is in surplus. The reason we feel battery producers should be proactive on hedging is that the expected supply this year will likely be short-lived. For example, Liberum predicts that the market will switch to a deficit next year, and more importantly, it could ultimately grow to 20,000 mt by 2026.

|

Aluminum

All major LME metals fell on Monday and Tuesday after China’s National People’s Congress set a lower-than-expected GDP target of 5% and failed to launch any stimulus measures at its meeting last weekend. AEGIS notes that metals demand and prices have been extremely vulnerable to Chinese stimulus measures and COVID policies in recent months. Specifically for aluminum, global prices rallied in January due to an expected revival in Chinese demand as the country reopened and abandoned its COVID policies. However, given that prices have dropped since late January because Chinese demand has fallen short of expectations while their domestic production remains robust, AEGIS feels that end-users can use this opportunity to hedge at lower prices compared to a mere 30 days ago. Being proactive on hedging might put you “ahead of the curve,” as some analysts are still optimistic about demand in 2023. For example, Commonwealth Bank of Australia analyst Vivek Dhar recently stated, “raw materials consumption will probably remain strong in the first half on pent-up demand from the re-opening at the end of last year.” (Source: Bloomberg)

However, according to Emirates Global Aluminum (EGA), there are pockets of growing demand in some markets. EGA, the largest aluminum producer in the Middle East, believes that global aluminum demand will grow by 1 to 2% this year, even if global economies slow due to rising interest rates. EGA also believes that aluminum prices will struggle due to the global economic slowdown. EGA had a record $2 billion profit last year, and its average LME sale price was $2,715/mt, according to company statements. (Source: Bloomberg, Reuters)

The LME aluminum market seems to agree with EGA’s assessment that demand will not significantly outpace supply this year. The current futures forward curve for LME aluminum through 2026 is in contango, suggesting that the market is currently well supplied. Also, prices have been rangebound in early 2023, with little volatility.

Molybdenum

On March 13, the CME will launch cash-settled molybdenum oxide futures, according to their website. AEGIS notes that this product offering comes as both the physical and financial markets for battery metals have gained greater interest in the past 12 months. Moreover, this will provide a hedging tool for both producers and consumers. Molybdenum has traditionally been used to harden steel; however, there is increasing interest in other applications, such as battery technologies. Also, molybdenum is a byproduct of copper mining, thus, copper miners can use the CME contract to lock in a revenue stream. Molybdenum prices have rallied nearly 120% in the past year due to supply issues and strong demand, according to Bloomberg. (Source: CME, Bloomberg)

AEGIS will watch this market as it matures and will keep customers and prospects abreast of any developments. We do caution that it sometimes takes a long time for new financial markets to gain traction. For example, the LME launched molybdenum oxide futures in 2010; however, interest has been essentially nonexistent. Moreover, there has been no open interest in LME molybdenum oxide futures since 2016. Prior to 2016, open interest rarely exceeded 40 contracts.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,313/mt, down $92/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $100/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 28.5¢/lb this week. The CME Midwest Premium market is backwardated through August 2023 but then becomes largely flat for the remainder of this year. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,867/mt, down $116.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $100/mt. The forward curve is now relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $22,684/mt, down $1,913/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $1,900/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,050/T, down $10/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/08/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

|||||

Notable News |

|||||

|

3/9/2023: Germany's Speira to end Rheinwerk aluminium smelting due to energy costs 3/9/2023: Peru mining firms' logistics at risk from extended protests, Fitch says 3/8/2023: Panama and Canada's First Quantum agree on final text for contract 3/7/2023: Cobalt supplies to swamp market, pressure prices further 3/7/2023: Emirates Global Aluminium's 2022 profit surges to a record $2 bln 3/7/2023: LME faces further legal action in London court 3/7/2023: US HRC: Prices up, mills push further 3/5/2023: Column: Automakers rush in where miners fear to tread 3/4/2023: Peruvian communities to resume blockade of crucial “mining corridor” |

|||||