|

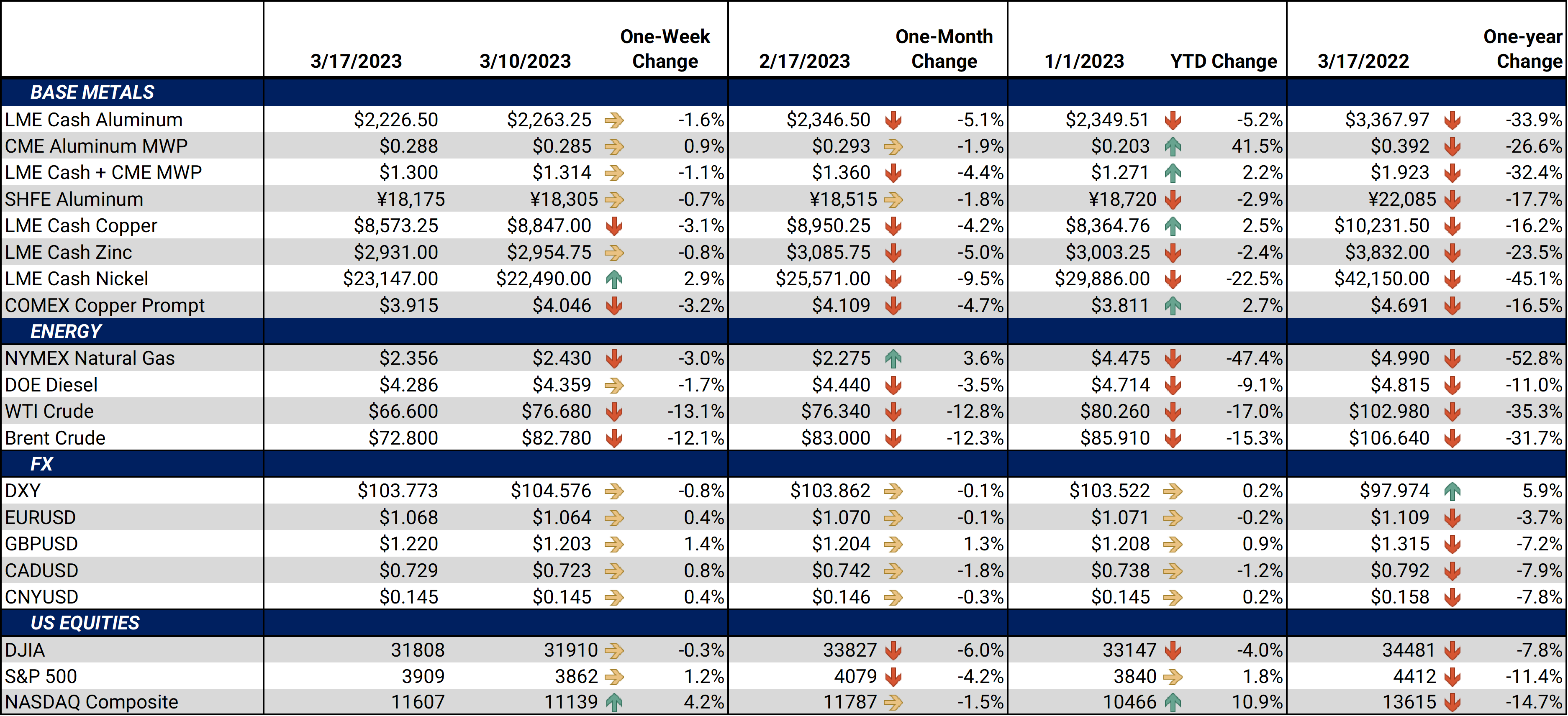

Aluminum Glencore will not renew its current 1.6 million mt per year purchase agreement with Rusal when it expires in 2024, the company stated on Thursday. In March 2022 Glencore stated it won’t do any new business with Russian companies due to the Russia-Ukraine conflict, but it would continue to honor current contracts. AEGIS notes that this should not materially impact Russian production, as Rusal can likely find new buyers (specifically China). However, there is the possibility that more Russian metal could wind up in LME warehouses, if that tonnage cannot find a willing end-user or buyer. (Source: Bloomberg)

|

More aluminum continues to flow into LME warehouses. As of February 28, LME aluminum warehouse stocks nearly doubled to 439,750 mt from the end of January total of 231,125 mt. AEGIS notes that this increased selling pressure has contributed to downward pressure on prices, which are lower by approximately 9% since February 1. Even though aluminum prices have tumbled in the past month, they are still roughly flat on the year. Aluminum end-users can hedge nearly at the same prices as seen in early January.

This significant increase in stocks stems from two regions, Russia and India. Russian-origin aluminum stocks were 200,600 mt as of February 28, over double the 93,600 mt that was in LME warehouses at the end of January. According to Bloomberg and Reuters reports, traders such as Glencore and others have been offloading large volumes of Russian-origin aluminum onto the exchange since last fall. Most of these volumes are going into South Korean warehouses, which are well-known depositories for Russian aluminum. The other major portion of this increase in stocks was the 122,050 mt of Indian-origin aluminum, most of which flowed into Malaysian warehouses. (Sources: Bloomberg, Reuters, LME)

|

|

As for production, on March 15, Alcoa announced they are curtailing production to 75% capacity, at its Portland smelter in Victoria, Australia due to “operational instability” stemming from rodded anode production issues. The total full annual capacity for the Portland smelter is 358,000 mt, but now will be approximately 268,500 mt. The Portland smelter is responsible for 19% of Australian aluminum production and about 0.5% of global production, according to Alcoa and USGS data. Alcoa did not provide an estimate on how long the curtailment could last. AEGIS believes this curtailment further highlights the supply-chain issues that smelters around the globe have faced in recent years. We also point out that is the first non-European or Chinese smelter to curtail production in recent memory. (Source: Alcoa, USGS) In other production-related issues, the situation in Europe shows no signs of slowing. European primary aluminum smelter capacity will shrink this year; however, the market impact will likely be minimal. German aluminum producer Speira Gmbh will close its 145,000 mt/yr Rheinwork primary smelter and revamp operations for aluminum rolling and recycling. The company cited stubbornly high electricity prices for the change. AEGIS notes that this could be an outlier event, as it is the first time that a European smelter has announced it is switching operations after a previous curtailment. If this trend continues, primary aluminum supplies could drop, leading to higher prices. The LME primary aluminum market has largely shrugged off the number of curtailments that have occurred in Europe, with prices finishing down about 15% last year and essentially flat in 2023. AEGIS wonders how much aluminum prices need to rally, or electricity prices need to fall, to entice production. According to our research, most aluminum smelters are subject to month-ahead electricity prices instead of longer-term contracts. Using our European smelter margin calculator which is based on month-ahead electricity prices, we estimate that in most cases margins are at least $800/mt away from enticing previously curtailed production to restart. We note that margins have improved dramatically over the past several months, largely because electricity prices throughout Western Europe have fallen by over 80% or more since last August. However, in some cases, electricity prices are still nearly double the historical norms. It appears that electricity prices need to fall further, or aluminum prices need to rally, to incentivize producers to increase production. |

|

|

|

AEGIS also wonders what margins would be like if these producers could lock in long-term contracts, as opposed to month-ahead prices. Using our European smelter margin calculator which uses TTF natural gas prices as a proxy for European electricity costs, we estimate that margins are still roughly $200/mt away from enticing curtailed production to restart again. We do note that this $200/mt is likely too low, as some smelters could likely briefly handle negative margins before curtailing production. Even using prompt month TTF futures appears to have better results than using month-ahead electricity, as the dip into negative margins using TTF pricing was shorter than month-ahead. We also note that the worst margins using TTF prices were approximately negative $1,500/mt, compared to over -$7,000/mt using month-ahead. Given that margins using TTF prices are much better than month-ahead electricity, it appears that smelters should lock in long-term electricity contracts, as opposed to month-ahead. |

|

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,274/mt, down $39/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $40/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 28.8¢/lb this week. The CME Midwest Premium market is backwardated through July 2023 but then becomes largely flat for the remainder of this year. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,580/mt, down $287/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $290/mt. The forward curve is now relatively flat throughout 2023 and 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $23,364/mt, up $680/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $700/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,056/T, unchanged on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/15/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

|||||

Notable News |

|||||

|

3/16/2023: US Steel restarts idled Indiana furnace 3/16/2023: Nucor expects higher steel shipments in 1Q 3/16/2023: Glencore will not renew $16 bln aluminium deal with Russia's Rusal 3/15/2023: Portland Aluminium joint venture in Australia to reduce production 3/14/2023: US steel prices driven up by multiple factors 3/13/2023: Molybdenum Oxide Daily Dealer futures contract launches on CME 3/13/2023: India to auction newly found lithium reserve 3/11/2023: Panama gives Canada's First Quantum go-ahead to operate port terminal 3/10/2023: Canada bans Russian aluminum, steel imports 3/10/2023: Panama minister expects contract with First Quantum will get green light 3/9/2023: Germany's Speira to end Rheinwerk aluminium smelting due to energy costs 3/9/2023: Peru mining firms' logistics at risk from extended protests, Fitch says |

|||||