|

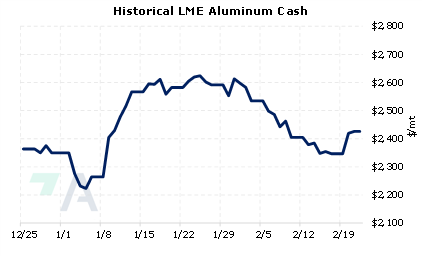

Aluminum prices could rally in 2023, as a nearly 80% drop in electricity and natural gas prices across Western Europe still isn’t enough to incentivize previously curtailed aluminum smelters to severely ramp up production, according to BloombergNEF. Based their analysis, BloombergNEF’s average aluminum price target for this year is $2,490/mt, which is approximately $60/mt higher than the current LME 3M Select price (7:00 AM CST). AEGIS also notes that this price target nearly matches the current $2,480/mt average price for 2023 LME aluminum futures. |

|

|

|

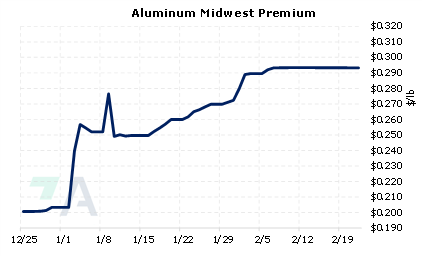

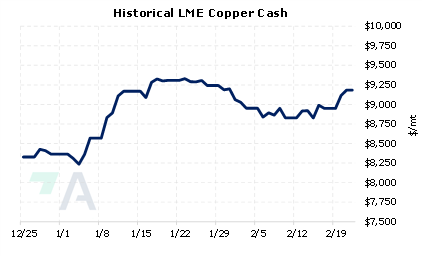

According to AEGIS’s European smelter calculator, using the TTF prompt price and the TTF futures curve, LME aluminum cash and LME alumina prompt, European smelter margins have turned profitable; however, not profitable enough to entice smelters to restart curtailed production. Therefore, AEGIS believes that either TTF prices need to fall further, or aluminum prices need to rise to entice European smelters to restart production. For example, smelters started shutting off or making curtailments announcements when our model showed profits margins at approximately $1,485/mt. Based on the TTF futures curve, the profit margins are about $1,375/mt. Therefore, aluminum prices need to rise at least $110/mt before we could (or will likely see) smelters come back online. Also, European supply issues are only a small part of the puzzle. Therefore, AEGIS believe we should look to Chinese demand and supply for cues on global prices. Regarding China, BloombergNEF points out that suppressed demand due to COVID lockdowns, along with record production, helped push aluminum inventories in China to the highest level since early 2021. However, AEGIS would like to point out that recent production curtailments in top-producing Yunnan province could weigh on the country’s total production this year. Also, Chinese buyers have increased aluminum imports over the past several years. Thus, even though Chinese inventories remain stubbornly high, aluminum prices could rally if China continues to draw on global supplies, or if more curtailments in Yunnan and elsewhere occur. (Source: BloombergNEF) Despite the recent rally, LME aluminum prices are barely higher on the year. However, prices could rally further if Chinese production falls more than expected, or if they draw further on global supplies. Aluminum end-users that are concerned about rising prices can hedge this price risk via swaps or call options. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (2/22/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

02/15/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

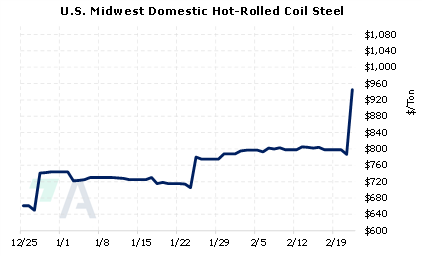

2/21/2023: US HRC: Prices jump as mills again hike prices 2/21/2023: BHP Group says reform to LME nickel contract 'long overdue' 2/17/2023: First Quantum sets Feb. 23 as date to halt Panama operations amid dispute 2/17/2023: Russians switch to used cars as sanctions pummel auto sector 2/16/2023: Exclusive: First Quantum warns employees that Panama mine may close if dispute is not settled 2/16/2023: Steep levies on Russian aluminium could threaten U.S. nickel supply 2/16/2023: Peru protests jolt mine activity with Las Bambas, Antapaccay hit hardest |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||