|

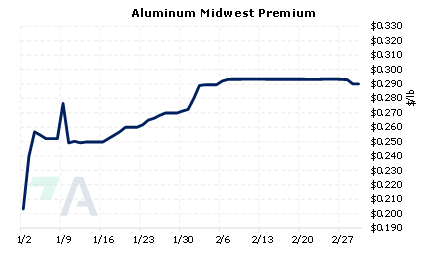

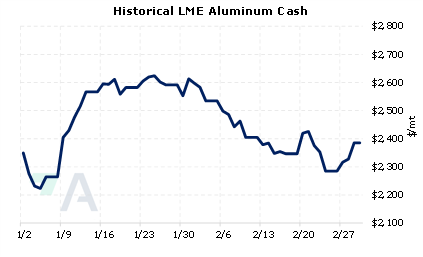

Last month, smelters in China’s top aluminum production region, Yunnan province, curtailed another 650,000 to 800,000 mt in annual capacity due to power rationing, according to Caixin. This is even deeper than the 415,000 mt of annual capacity requested by local authorities in mid-February. AEGIS notes that aluminum prices are essentially flat since this latest round of curtailment requests and are similarly flat on the year. Given that LME aluminum prices were down over 15% last year, and that supply issues in China are potentially bullish, AEGIS believes this is an excellent time for consumers to lock in future usage. (Source: Bloomberg) |

|

|

|

AEGIS also notes that this latest round of curtailments now brings Yunnan province’s total cuts to 1.9 million mt in annual production capacity, meaning that approximately one-third of the region’s production is now offline. At 5.3 million mt, Yunnan Province’s annual capacity is responsible for about 12% of China’s aluminum production capacity. AEGIS also wonders how long this production will remain offline, and more importantly, if Chinese consumers will need to fill the void by further relying upon imports. Likewise, will more curtailments occur, and will that force end-users to pull even more from global supplies? As AEGIS suggests, this latest round of curtailments and the possibility of more or prolonged cuts provide a bullish catalyst for LME aluminum. However, end-users can hedge this price risk via swaps or call options. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/2/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/01/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

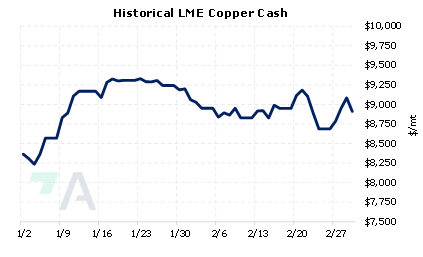

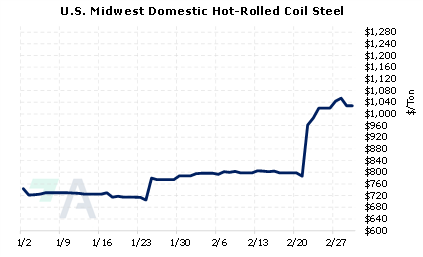

3/1/2023: Tesla plans 6,000 jobs in Mexico and eyes more investment, government says 3/1/2023: Freeport Indonesia says Grasberg mine operations back to normal after floods 2/28/2023: Panama and Canada's First Quantum nearing agreement over copper mine -lawyer 2/28/2023: LME halts flow of Russian metals into its U.S. warehouses 2/28/2023: Column-United States targets Russian aluminium and other metals: Andy Home 2/27/2023: Stellantis invests $155 mln in Argentine copper mine 2/28/2023: Analysis: Lithium price slide deepens as China battery giant bets on cheaper inputs 2/27/2023: A $1.5 billion hoard of copper and cobalt is piling up in Congo |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||