|

To secure supplies of battery metals such as cobalt, lithium, and copper, automakers such as Tesla, GM, and Stellantis (formerly Fiat Chrysler) are considering or have already invested in mining operations throughout the world, according to Bloomberg and Reuters. However, earlier this week Goldman Sachs commented that these investments will likely “end in tears” due to the expertise involved in mining projects. Extrapolating further, Goldman Sachs stated, “car companies will be better off sticking to their core competencies and reducing their exposure to commodity price swings through hedging.” |

|

|

|

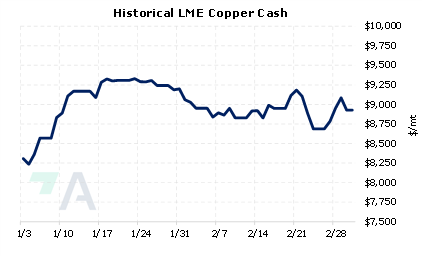

AEGIS fully agrees with these comments. More importantly, AEGIS is very adept at creating and implementing strategies for cobalt, copper, and other battery metals. This might include a variety of strategies involving swaps and options. For example, LME copper has sufficient liquidity for both swaps and options. CME Cobalt futures has seen explosive growth in open interest in recent months. Please note that there is no options market for CME cobalt. As for lithium, open interest remains low. However, if you need to hedge lithium, we suggest using limit orders. This would allow you to control your purchase price. For example, if you were trying to buy April Lithium at $72/kg, by using a limit order, you are attempting to lock in a price of $72/kg or better. Please contact AEGIS for specific strategies that fit your operations. (3/3/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

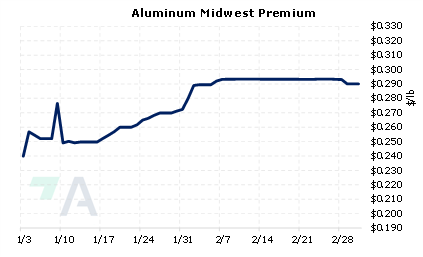

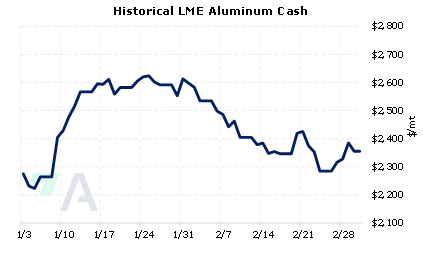

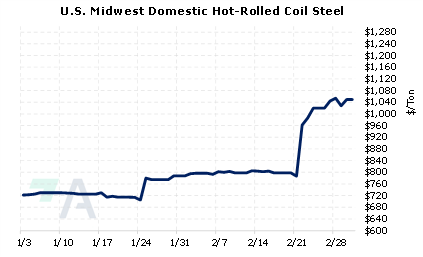

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/01/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

3/3/2023: Volkswagen board discusses two new North America plants at meeting - sources 3/2/2023: Lithium miner SQM's profit more than triples on EV demand 3/2/2023: Aluminium open interest, volume on CME hit record high in February 3/1/2023: Tesla plans 6,000 jobs in Mexico and eyes more investment, government says 3/1/2023: Freeport Indonesia says Grasberg mine operations back to normal after floods 2/28/2023: Panama and Canada's First Quantum nearing agreement over copper mine -lawyer 2/28/2023: LME halts flow of Russian metals into its U.S. warehouses 2/28/2023: Column-United States targets Russian aluminium and other metals: Andy Home 2/28/2023: Analysis: Lithium price slide deepens as China battery giant bets on cheaper inputs 2/27/2023: A $1.5 billion hoard of copper and cobalt is piling up in Congo 2/27/2023: Stellantis invests $155 mln in Argentine copper mine |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||