|

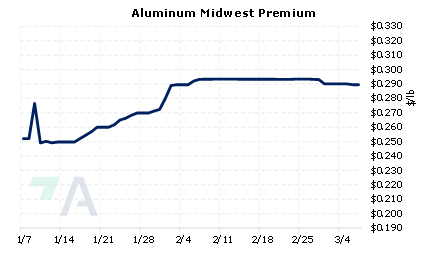

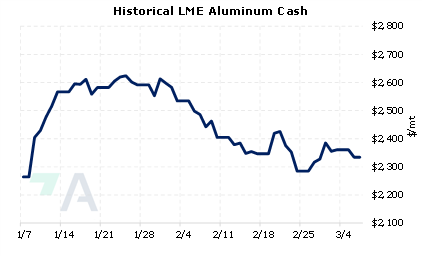

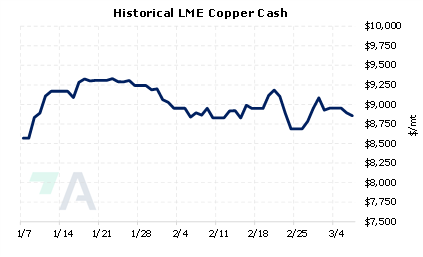

All major LME metals fell on Monday after China’s National People’s Congress set a lower-than-expected GDP target of 5% and failed to launch any stimulus measures at its meeting last weekend. AEGIS notes that metals demand and prices have been extremely vulnerable to Chinese stimulus measures and COVID policies in recent months. Specifically for aluminum, global prices rallied in January due to an expected revival in Chinese demand as the country reopened and abandoned its COVID policies. However, given that aluminum prices have dropped since late January because Chinese demand has fallen short of expectations while their domestic production remains robust, AEGIS feels that consumers should use this recent drop in prices to hedge future usage. Being proactive on hedging might put you “ahead of the curve,” as some analysts are still optimistic about demand in 2023. For example, yesterday Commonwealth Bank of Australia analyst Vivek Dhar stated, “raw materials consumption will probably remain strong in the first half on pent-up demand from the re-opening at the end of last year.” (Source: Bloomberg) |

|

|

|

As we noted above, LME aluminum prices are relatively flat this year, as hopes that Chinese aluminum demand will increase have waned. However, as we suggest above, prices could rise if China implements new stimulus measures. Aluminum end-users that are concerned about rising prices can hedge this price risk via LME swaps or call options. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/7/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/01/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

3/7/2023: LME faces further legal action in London court 3/5/2023: Column: Automakers rush in where miners fear to tread 3/4/2023: Peruvian communities to resume blockade of crucial “mining corridor” |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||