|

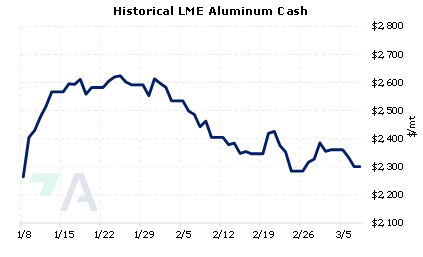

Emirates Global Aluminum (EGA), which is the largest aluminum producer in the Middle East, believes that global aluminum demand will grow by 1 to 2% this year, even if global economies slow due to rising interest rates. EGA also believes that aluminum prices will struggle due to the global economic slowdown. EGA had a record $2 billion profit last year, and its average LME sale price was $2,715/mt, according to company statements. (Source: Bloomberg, Reuters) |

|

|

|

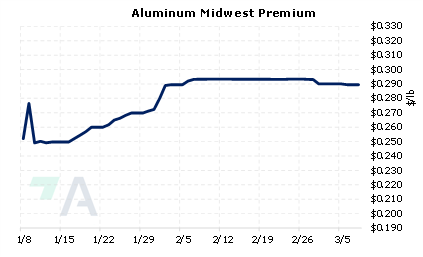

The LME aluminum market seems to agree with EGA’s assessment of demand will not significantly outpace supply this year. The current futures forward for LME aluminum through 2026 is contango, suggesting that the market is currently well supplied. Also, prices have been rangebound in early 2023, with little volatility. If EGA is correct, consumer hedgers should be watching for a scenario where immediate pessimism on the global economy artificially suppresses longer-term aluminum prices. If this happens, the prepared hedger could lock in some low-cost aluminum using very simple hedging structures. Start early; we'll help you plan. (3/8/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

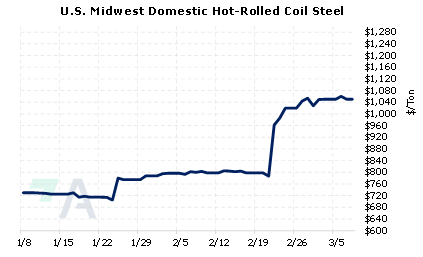

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

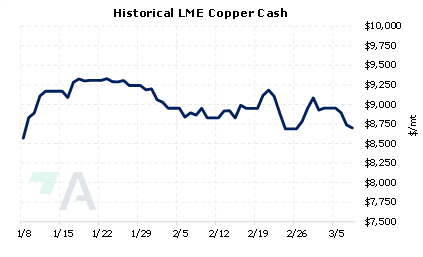

03/01/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

3/7/2023: Cobalt supplies to swamp market, pressure prices further 3/7/2023: Emirates Global Aluminium's 2022 profit surges to a record $2 bln 3/7/2023: LME faces further legal action in London court 3/5/2023: Column: Automakers rush in where miners fear to tread 3/4/2023: Peruvian communities to resume blockade of crucial “mining corridor” |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||