|

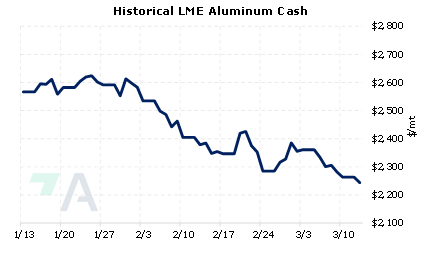

European primary aluminum smelter capacity will shrink this year; however, the market impact will likely be minimal. German aluminum producer Speira Gmbh will close its 145,000 mt/yr Rheinwork primary smelter and revamp operations for aluminum rolling and recycling. The company cited stubbornly high electricity prices for the change. AEGIS notes that this could be an outlier event, as it is the first time that a European smelter has announced it is switching operations after a previous curtailment. If this trend continues, primary aluminum supplies could drop, leading to higher prices. |

|

|

|

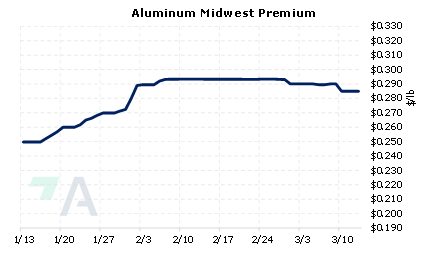

If you are concerned that aluminum prices could rise due to more curtailments or to entice production, we suggest using LME swap or call options to hedge your price risk exposure. Even though the futures forward curve is currently in contango, it has shifted lower by approximately $200/mt in the past 90 days. Thus, aluminum end-users can lock in better prices compared to three months ago. Please reach out to AEGIS on how to hedge your aluminum end-usage. (3/13/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

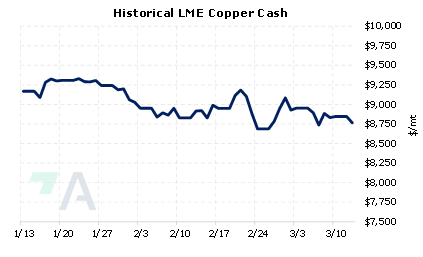

03/08/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 |

||

|

|

||

| Important Headlines | ||

|

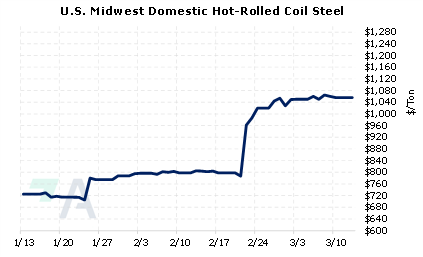

3/9/2023: Germany's Speira to end Rheinwerk aluminium smelting due to energy costs 3/9/2023: Peru mining firms' logistics at risk from extended protests, Fitch says 3/8/2023: Panama and Canada's First Quantum agree on final text for contract 3/7/2023: Cobalt supplies to swamp market, pressure prices further 3/7/2023: Emirates Global Aluminium's 2022 profit surges to a record $2 bln 3/7/2023: LME faces further legal action in London court 3/7/2023: US HRC: Prices up, mills push further 3/5/2023: Column: Automakers rush in where miners fear to tread 3/4/2023: Peruvian communities to resume blockade of crucial “mining corridor” |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||